PayPal is one of the online financial institutions with the most users. It has been on the market for a long time and is gaining more followers daily. Almost all users who make online transactions have an account on the platform and wonder if is Chime compatible with Paypal. Or “Can you link Chime to PayPal?” and, if so, how to link Chime to paypal?

First, you should ask yourself if you can connect PayPal with other options such as Chime and then link Chime to paypal . Both platforms are simple to use and have many benefits and possibilities for their users. There is one big difference between the two, and that is the transaction fees.

Can I link PayPal with Chime?

Users wonder if “Does PayPal work with Chime?” or whether can you send money from PayPal to Chime, but they don’t have to worry because the answer to “Does PayPal accept Chime?” is Yes. You can link PayPal with Chime to make your transactions more straightforward and faster. However, there is no direct way to make the linking, on the contrary. So, how can you send money from Chime to PayPal? Let’s see how can I link Chime to PayPal how can I send money from PayPal to Chime .

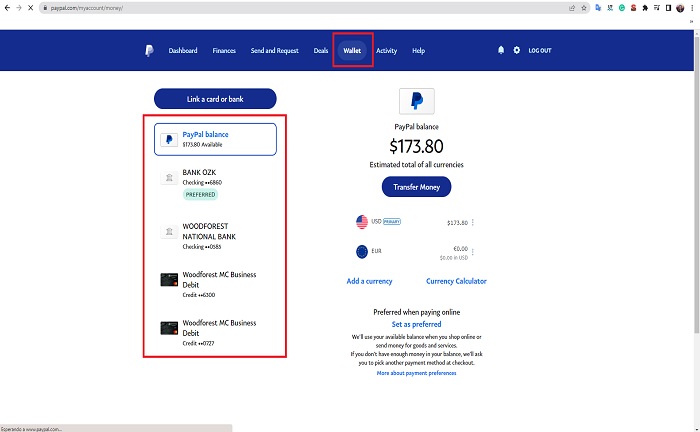

The first thing to link PayPal with Chime is to open PayPal from your browser and find the menu to send and receive payments. To complete this, you must access your account, click on the “Wallet” menu, and the “Bank and cards” option will appear.

A page with all the banks and cards you have linked to your account should be displayed; there, you will see the option “Link a debit or credit card,” and the possibilities to add will appear, but Chime does not appear in the list.

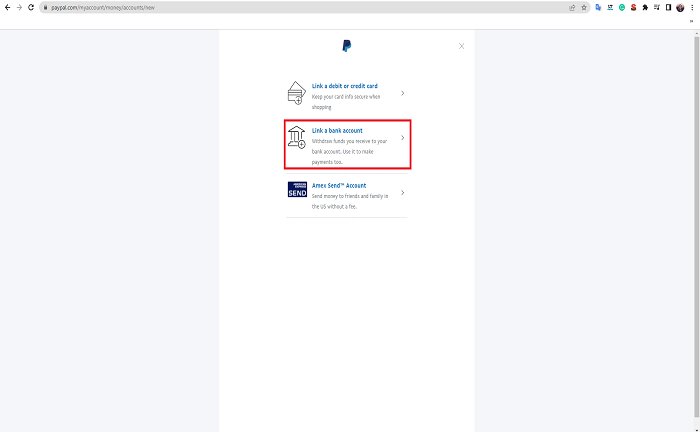

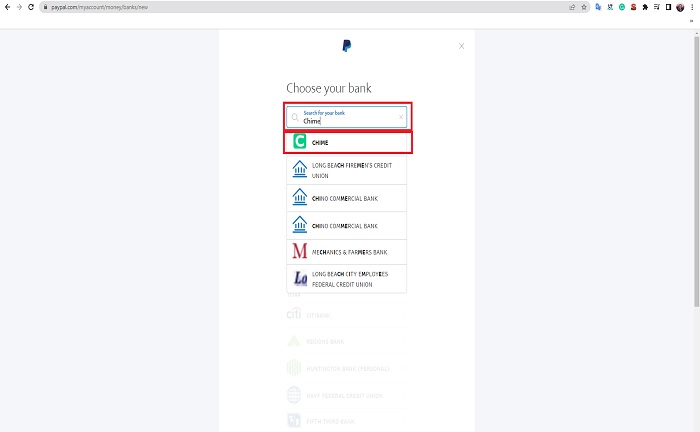

Select “Link a bank account” and type “Chime” in the search bar to add it.

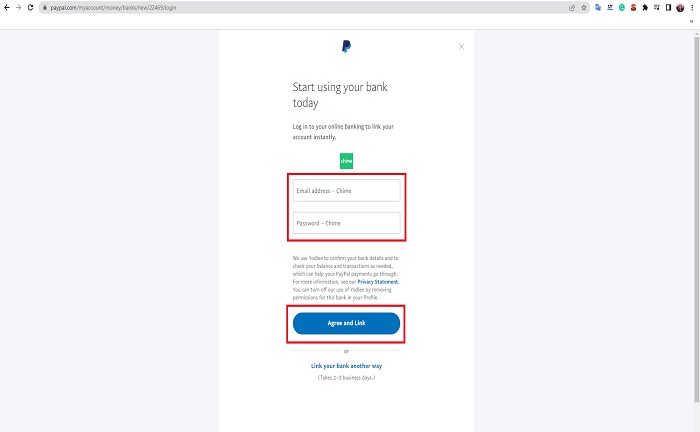

When you click on the option, you must add the e-mail with which you have linked the Chime account and the user password of the same account. Then you must press “Agree and Link” and Ready!

What is the process of sending money from Chime to PayPal?

You now know the answer to “Can I send money from paypal to Chime?” so let’s see how can I transfer money from Paypal to Chime. First, you should know that Chime is a prepaid card for PayPal because it works with Bancorp. That’s why there is no direct way to send money from Chime to PayPal. So, now that you are aware whether can I send money from Chime to Paypal and if can I link Chime to paypal let’s see how

So far, the procedure can be done in three different ways; you can try each to find the one you feel more comfortable with. Likewise, it is essential to mention that it is not mandatory to recharge the PayPal account to make payments because by connecting your card to Chime, you can make payments easily if you have funds in the second option.

Using your Chime account as a bank to move funds to PayPal

Although Chime is not a bank, it can function as one because it issues checks, FDIC insurance, and bank numbers. By adding your account number and routing in the bank section of PayPal, you will be using it as one.

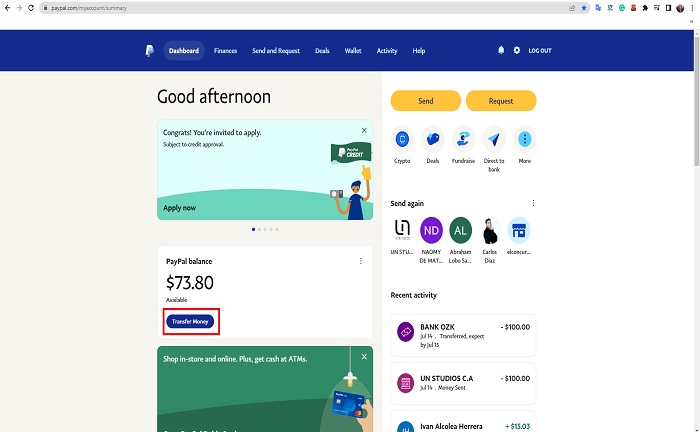

Once you have linked both accounts, it’s time to transfer funds between Chime Paypal. This way, you won’t have to adhere to Chime’s maximum transfer limits. For the procedure, log in to the PayPal account from your phone or PC, go to “Balance,” and click “Transfer Money.”

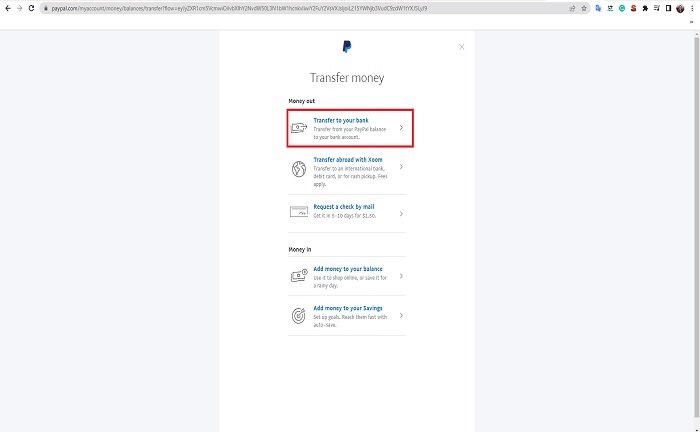

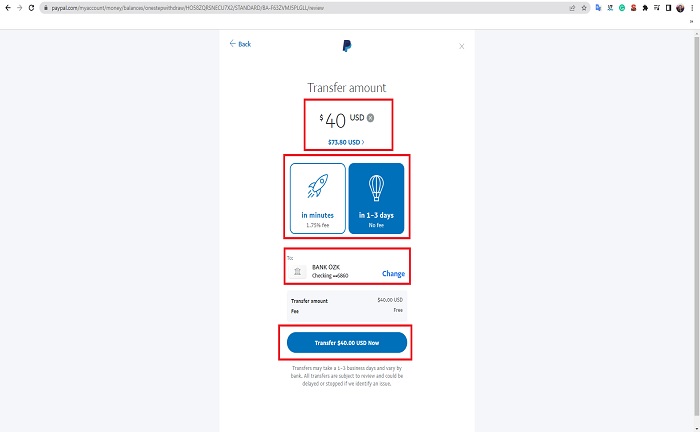

Select “Transfer to your bank” so you can enter the amount to transfer, the time you want to wait, and the bank option where you must enter Chime’s bank. Finally, you must press “Transfer,” and that’s it; it’s a simple procedure.

Use one of your linked accounts to move money from Chime to PayPal

With this method, you don’t need to connect Chime to PayPal directly or a PayPal cash card. The process is simple: log in with your Chime account and find the option “move money.”

On the next page, you must select “transfers” and the external bank you will use. All that remains is to add your routing and account number in the marked fields. After linking your Chime account with the external account, it is time to connect it with PayPal.

Now, send the money from Chime to the external bank and wait five business days for it to appear. Then, you can transfer it to Paypal Chime.

Transfer money from PayPal cash card to Chime account

After knowing that can you link PayPal to Chime, the movement is so easy, so how can I link paypal to Chime? How can I link my Paypal to Chime? how to With the PayPal cash card, you can deposit funds directly as if it were a traditional bank account. You can even use it like a MasterCard, allowing you to make ATM withdrawals.

To apply for this card, you need to verify your PayPal account; you can do this by linking your bank account, credit card, or debit card with PayPal. To make the request, log in to your PayPal account and go to “get the card.”

You will be asked to log in again, and on the new page, select “order a cash card” and confirm the delivery address. You should expect to receive it within ten days.

Once you have it, only log in to the Chime application and select “move money.” Go to “transfers” and enter your PayPal cash card’s account and routing number. Now, you must do the traditional procedure to transfer funds from one account to another.

What is the transfer limit?

Now that you know if can you transfer money from paypal to Chime, with a verified PayPal account, you can make a maximum of $10,000 transactions. But with the Chime Pay Friends method, you can only send $2,000 monthly. When transfers are to external banks, the daily limit is $200 and $1,000 monthly.

How do we solve linking problems between accounts?

Problems usually occur when you do not have a verified PayPal account. But don’t worry because they can be solved by linking your debit card or adding your bank details to the platform. Problems can also occur if your Chime account and routing numbers are incorrect.

It is essential to verify all information before proceeding with the process. Follow each of the above steps, and you can link properly. Try not to skip any because problems can arise.

How long does it take for money transfers between accounts to fall through?

If you wonder how long does it take to transfer money from Chime to PayPal, the time is not exact. But we have an approximation. When you move money from PayPal to Chime or vice versa, you must wait at least one business day for it to show up in your Chime and PayPal accounts. Depending on the clearing process with the bank, this may take two to five business days.

Chime vs PayPal: Which one is better?

Now that you know that you can link PayPal to Chime and the answers to “Can you connect Chime to paypal?” or “Can I use Chime with paypal?”, the ideal service will vary depending on your financial needs, banking habits, usage of these platforms, and personal preferences. Chime may be optimal if you prioritize quick transactions and zero fees.

On the other hand, if you require an online payment platform for your business or desire a widely accepted service with many features, PayPal might be the best option. Now, let’s delve into the critical details of PayPal and Chime.

Chime Pros and cons

Advantages

One of the critical advantages of Chime is its ability to facilitate faster transactions compared to PayPal. This can be particularly beneficial for individuals prioritizing speed and efficiency in their financial transactions. Chime also offers no commissions, allowing users to save on transaction fees.

This virtual wallet is known for its excellent reliability, ensuring users can trust the platform for their banking needs. Another notable advantage of Chime is its feature that allows users to block their cards.. Lastly, Chime offers attractive financial incentives, such as a 0% annual return and 6% interest, which can appeal to those looking to maximize their savings.

Disadvantages

Despite its advantages, Chime does have a few drawbacks. One of the main disadvantages is that it is less recognized and used than PayPal. This may limit the availability of Chime as a payment option in certain situations.

Additionally, Chime may have fewer integrations with other services and software, which could be a drawback for individuals who rely on a wide range of platforms for their financial needs. However, the answer to “Can you use Chime with Paypal“? or “Can I link my Chime card to Paypal?” is yes, as they are compatible, as it happens with Zelle.

PayPal Pros and cons

Advantages

PayPal has several advantages, making it a popular choice for many individuals and businesses. One of the key advantages is its widespread acceptance and usage by numerous companies and individuals. This makes PayPal a convenient option for making payments and receiving funds.

Furthermore, PayPal offers a variety of features, including invoicing, payment processing, and money transfers, making it a versatile platform for various financial needs. Another significant advantage of PayPal is its buyer and seller protection, which provides added security and peace of mind for transactions.

Lastly, PayPal proposes a wide range of integrations with other software and services, allowing users to connect their PayPal account with other platforms seamlessly, like linking PayPal to Zelle.

Disadvantages

While PayPal has many advantages, it has a few disadvantages. One potential drawback is the high fees that merchants may incur when using PayPal for their business transactions. These fees can eat into profits and may concern businesses with tight profit margins. Furthermore, PayPal may impose limits and restrictions on accounts, frustrating users who require flexibility in their financial transactions.

Another disadvantage of PayPal is its high currency exchange fees, which can be costly for international transactions. Lastly, some concerns have been raised about data protection and disputes on the PayPal platform, which may be a consideration for individuals prioritizing privacy and security.