Afterpay is an application where you can make your purchases with convenience. You can purchase goods and services in a simple and fast way. When you purchase products, you can make payments if you have cash in your account.

It is a platform where you can make payments in four installments, the first must be 25% of the cost at the end of the purchase, and the other parts are divided into six weeks. Many users wonder “Can you use Chime for Afterpay?” and want to know if they can make these payments with Chime. So let’s find out if can you use Chime with Afterpay and if does Afterpay work with Chime

Is it possible to use Chime for Afterpay payments?

Among the options is Chime for Afterpay payments; you need to associate your account to complete payments for products and services purchased. One of the best ways to do this is with the Chime debit card because Visa issues it.

Procedure to add the Chime debit card to Afterpay

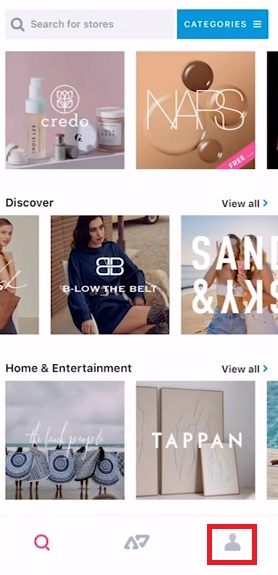

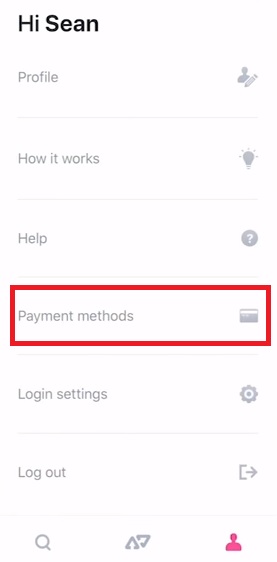

To start, you need to log in to the AfterPay website; if you are a new user, you must create a new account following the steps below; it is simple. Once you have it, go to “My Account” (it has the icon of a person) and look for the “Payment Methods” section. On the new page, look for the card icon.

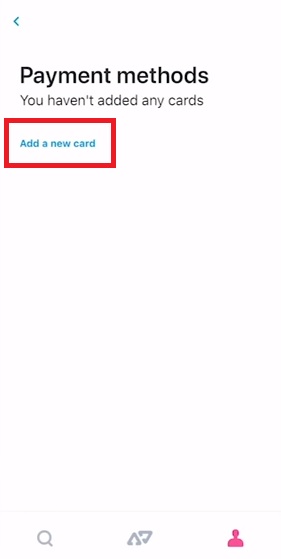

Here you will see the registered cards and the option to add a new one.

The fields indicate the information you must add to your Chime Afterpay card; you must add the card number and details to complete the transaction.

Make sure to verify that all the information added is correct to avoid being rejected and having to start over. When you are done, press “save“, and you are done. You can now start using your Chime account to make payments for your Afterpay products.

How to make payments in Afterpay with the platform?

After adding your Chime debit card to Afterpay, you only have to log in to your Afterpay account and go to “Account. You will see your pending payments and select the one you want to pay.

On the next page, select the card you will use to pay; in this case, it will be Chime. Confirm the procedure and wait for the payment confirmation message to appear. That’s all! Now you have learned whether can i use Chime with afterpay or not.

What cards does afterpay accept?

To complete your payments in Afterpay and Chime, you can use credit or debit cards, including Visa, MasterCard, and American Express. The only cards that are not accepted are those of foreign banks. Prepaid cards are also not accepted because they are rarely linked to a bank account.

How to use Afterpay?

After knowing what cards do Afterpay accept, let’s talk about Afterpay Chime. Online shopping is the most common way to use this payment; everyone prefers this method to complete their purchases of products and services. To be chosen as a user who can use Afterpay, you must meet certain requirements:

- You must be at least 18 years old. If you live in Alabama or are a ward of the state of Nebraska, you must be 19 years old

- You must be a resident of the United States or live in the country

- Provide a valid delivery address

- Add an email address and phone number

- Have authorization to use the credit or debit card selected to link to Afterpay

If you cannot meet any of the above requirements, you will not be selected to purchase on the app.

What does it mean to buy now and pay later?

Put it is the ability to access a service where you pay for a portion of the product or service purchased and get a reasonable period to catch up on the rest of the payment. With Afterpay, you can complete it in four installments. The time you will have will depend on what you have purchased and the amount; the application will indicate this once you process the information.

Does Afterpay accept Cash app?

Another frequent doubt among users who wonder “Can I use Chime on Afterpay?” is “Do AfterPay take Cash App?”. Fortunately, the answer is yes, Afterpay accepts Cash App as a payment method, allowing to use Cash App for purchases with Afterpay merchants conveniently. You can choose Cash App as your preferred payment option during checkout, streamlining the transaction process.

Using Cash App with Afterpay offers several benefits. You can easily manage your Afterpay orders and payment details within the Cash App application, accessing important information like order amount, payment schedule, and remaining balance in one place.

Additionally, Cash App lets you pay for your Afterpay purchases using funds from your Cash App account. This feature ensures you can stay on top of your payment schedule and allocate funds towards Afterpay installments within the same platform.

However, the answer to “Does Afterpay take Cash app?” may vary among AfterPay merchants. To ensure a smooth checkout experience, always verify the accepted payment options the specific merchant provides and confirm that AfterPay Cash app is listed as an accepted payment method.

By accepting Cash App, Afterpay enhances flexibility and convenience for users, simplifying the payment process and providing a seamless experience.

How to transfer money from AfterPay to Cash app?

Transferring money from AfterPay to Cash App is not a direct process. Afterpay is a buy now, pay later service, while Cash App is a mobile payment platform. To transfer funds from Afterpay to Cash App, you would need to follow these general steps:

- Make sure to complete your outstanding payments according to the agreed-upon schedule with Afterpay.

- Once you have completed your payments, any remaining funds will be available in your bank account.

- Connect your bank account to Cash App by following the provided instructions within the app.

- Initiate a transfer from your bank account to Cash App using the options available within the Cash App application.

FAQs

Do Afterpay accept Chime?

We now know the answer to “Can you use Chime on Afterpay?” but does Afterpay take Chime? The answer to “Does Afterpay accept Chime? is yes, Afterpay accept Chime because both companies work together. Therefore, if Chime takes Afterpay, it can be inferred that the same is true in the opposite case. So, the answer to “do Afterpay take Chime?” or “Does Afterpay work with Chime?” is also yes.

Does Klarna accept Chime?

No. Klarna accepts all major debit and credit cards including Visa, Discover, Maestro, and Mastercard, but does not accept prepaid cards, so those respond to “Does Klarna take Chime” and “Why doesn’t Klarna accept Chime”.

Does Zip accept Chime?

Zip (formerly QuadPay) accepts Chime as a payment method. This means that users can link their Chime debit card to their Zip account and utilize it to make purchases using the Buy Now Pay Later service Zip offers.