The first bank to eliminate overdraft fees was Capital One. It also eliminated insufficient funds fees, which are now a thing of the past as of 2022.

After this decision, many banks joined in and offered solutions for their consumers. Overdraft fees used to be quite high, generating many complaints from customers. Let’s see some banks with open checking account online instantly with no deposit with overdraft

What banks let you overdraft right away?

Many banks are willing to offer you overdrafts, but not all of them will approve them immediately, and many charges too high-interest rates. Here are the accounts that provide fast and affordable overdrafts, banks that let you overdraft immediately, and online banks that let you overdraft right away without direct deposit:

Capital One 360 Checking with your bank account

Since the beginning of 2024, Capital One has been one of the online banks that allows you an immediate overdraft without direct deposit. It offers its customers fast overdrafts without additional fees, and it’s an excellent option for not only that, but you also enjoy an account with no monthly maintenance fees, minimum deposit, or minimum balance requirements.

You can access a 0.10% APY and its extensive ATM network. Capital One has offered overdrafts for a long time but, until now, decided to eliminate surcharges.

Ally Interest in your checking account

You get overdrafts quickly and with no additional fees; their accounts do not require a minimum deposit or a specific balance. It is a preferred account for many citizens because of the convenience of withdrawing their funds.

Cashback with your debit account

In addition to having no interest on your overdrafts, it won’t take money from your Discover savings account to replenish the overdraft amount. It’s a great solution when you need cash immediately but doesn’t want to cover large fees.

It’s a great account bank because it doesn’t have a maintenance fee or require you to maintain a minimum balance. You’ll also enjoy rewards for your spending even if you request an overdraft.

Axos Bank Rewards Checking

This is another of the many online banks with instant overdraft that allows you to overdraw your Essential Checking, Fist Checking, or Rewards Checking account. You can link it to another account or line of credit. One of its great benefits is that it has no overdraft fees.

Bank of America

You can get your overdrafts immediately. It also has an optional overdraft protection service where you can link your checking account to second savings, checking, or credit card account.

That way, you can cover overdrafts more simply. As for fees, Bank of America does have some, depending on the transfers or transactions you are making.

Chase Bank

Like the other banks mentioned above, the approval of your overdrafts is done immediately. It also has a protection service that allows you to link the account to a savings account to cover your overdrafts.

However, that service is unavailable if you have a Chase Secure Checking account. Eliminated fees for overdraft transfers.

Alliant Credit Union

While Alliant is not a bank per se, it is a credit union that works just as a bank that lets you overdraft money instantly. It is even one of the first institutions to eliminate the extra fee for this transaction.

Most banks and credit unions still charge up to $35 for an overdraft, even if you overdraft more than once a day.

In addition, their credit line does not allow overdrafts, which can be beneficial, especially if the person does not have cash. On the other hand, Alliant gives you the ability to overdraft. The method is called “Courtesy Pay” and is intended to help customers avoid having declined transactions generated for them.

Important: you need to be a credit union member (for at least 6 months) and transfer $600 to your checking account per month to access these overdraft benefits. Please note the overdraft amount must be paid as soon as possible.

SoFi

One of the most relevant online banks today is SoFi. Among its benefits is that it does not charge a fee for overdrafts. Similar to Alliant, you can access two overdraft options.

The first allows you to transfer money from your savings account to your checking account to cover the overdraft. It works as a protection at no additional charge. The second is coverage, where SoFi allows you to use a debit card, which can be overdrawn up to $50. For this to occur, the customer must deposit ,000 a month in direct deposits.

U.S. Bank

It is another bank that lets you overdraft right away. U.S. Bank allows you to overdraft by $5 and will not charge you an additional fee. However, be careful because if you overdraw by even a penny more, you will have to pay a $36 fee.

To prevent this from happening, link your savings account to your checking account to protect you from the overdraft fee. However, depending on the account, you could pay up to $12.50 per overdraft. There may be better options than this. However, if this is your primary bank, it is beneficial for overdrafts, at least on low amounts.

PNC Bank

This bank is one of the best for overdrafts. It offers protection if you link your checking account to your savings account, although you can also connect your checking account to a personal line of credit or credit card.

The cost of the protection is $36, which is cheaper than PNC Bank’s standard overdraft fee. If you don’t check your balance, you can decline any withdrawals with your debit card if you need more money in the account. Plus, it limits you to four overdraft fees per day.

SunTrust Bank

This is one of the banks that let you overdraft at ATM. It allows you to make ATM withdrawal transactions with your debit card, even if you don’t have enough money in your account. It is one of the best overdraft options. It provides assistance, protection, and coverage if you become overdrawn.

SunTrust Bank will charge you a $36 fee for each purchase despite this benefit. You have access to a maximum of 6 transactions per day, but you will not be penalized if the overdraft is less than $5.

This bank’s overdraft protection service guarantees that no overdraft or transaction will be declined once you access it (guaranteed bank account with overdraft). Each transaction costs $12.50, but if you deposit funds to cover the overdraft on the same day, you can avoid it. You also need to link a savings account, credit card, or line of credit to your checking account to transfer funds.

Other banks where you get immediate overdrafts

Bmo Harris (Find nearest bmo Harris)

They have a “Smart Money Account” with no overdraft fees. This is a checking account where you only pay $5 per month in maintenance fees ($0 if you are under 25).

It is an ideal bank account for those who tend to overdraw their purchases. If you make a cash withdrawal at an ATM, the transaction will be rejected, preventing an overdraft from occurring. These are its main features:

- Make your bank transfers digitally.

- It only requires $25 to open the account.

- Access to more than 40,000 ATMs.

- Transfer your money to your Zelle account.

- Manage your transactions securely and quickly.

- You get a Mastercard debit card.

Bank of Huntington

In case you overdraw your Bank of Huntington debit card, they have an option for you to pay your transactions in these cases. There are two ways they offer to cover overdrafts:

- Checking accounts (bank accounts that let you overdraft) have standard overdraft practices. These already come when you open the free online checking account no opening deposit with overdraft.

- Overdraft protection plans. You can choose to link a savings account. This way, you avoid the fee. For information on this alternative, consult your bank advisor.

Bank of Huntington authorizes and pays overdrafts on checks and automatic bill payments. However, if you withdraw at an ATM, the overdraft will only be made if you request it. You should also know that the bank only authorizes overdrafts at its discretion. They do not guarantee that it will always be approved and covered.

Unlike other banks that do not charge overdraft fees, Huntington’s bank charges $15 per transaction. The fee will be waived if the account is overdrawn by more than $50. They also have a limit of 3 charges per day.

Fifth Third Bank

This is another of the banks that allow overdraft, and standard coverage is available. If your checking account is not funded, you can pay your transactions with checks, ACH deposits, and bill payments.

Plus, you have “Fifth Third Extra Time” (available with Momentum Checking). With this option, you have extra time to make a deposit. You avoid the overdraft fee. If you become overdrawn, you will receive a notification in your Online Banking the next business day.

Fifth Third Bank charges one of the highest overdraft fees of any bank. The overdraft fee is $37, regardless of the times it has occurred. Additionally, the fee will only be charged for up to 3 overdrafts per day.

Discover

Overdraft protection is also available. In this case, it consists of a link between your Money Market or savings account and another deposit account that transfers the necessary funds to avoid the inconvenience of returning items when there is insufficient money in the account.

Overdrafts Protection covers online bill payments, ACH transfers, and checks. However, it does not apply to ATM withdrawals and debit card transactions.

Discover’s overdraft protection feature is quite simple: the service automatically initiates a funds transfer from your selected overdraft protection account. However, you must enable the service. It is not an option that comes already activated in the account.

To do this, when you log in to the Account Center, see “Overdraft Protection.” You will see it under “Accounts.”

If you were wondering what bank lets you overdraft immediately, Discover does not charge an extra fee to use this overdraft protection insurance. Also, it’s one of the best options because, as of 2019, Discover removed the costs associated with overdraft fees.

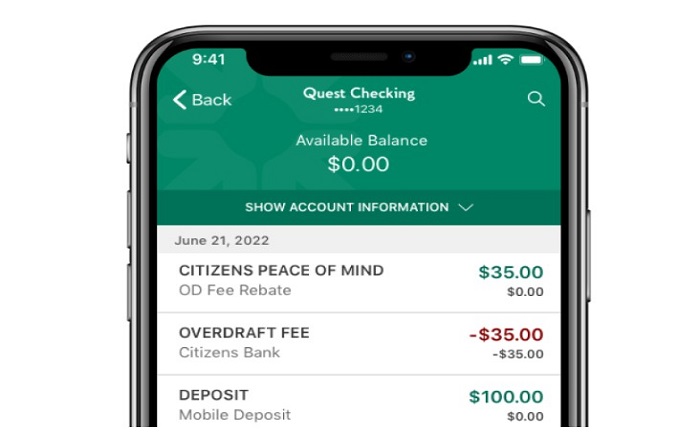

Citizen’s Bank

For those who tend to overdraw, Citizen’s Bank brings you “Citizens Peace of Mind.” It is an option that helps you prevent unexpected overdraft costs. It is a means that gives you extra time to add funds to your account to reverse the fees.

The system will send you an alert to your cell phone notifying you of what happened. That way, you have time until 10:00 p.m. that day to make the deposit in your account and cover the amount spent. Then, the bank will reimburse you the next business day for the overdraft fee. It’s a relatively easy method to understand and use.

TD Bank

“TD Overdraft Relief” (does not apply to core accounts) is an easy option to avoid overdraft fees. They give you flexibility if this happens. They have another good way in case of bank accounts with overdraft.

They give you a grace period (similar to Citizen’s Bank) until 11:00 p.m. the next business day you overdraft to make a transfer or deposit to cover the fee.

Make sure your account balance is at least $0. You do not need to deposit more money than necessary. They will also reimburse the fee to your checking account if you make the transaction within the given time frame.

Important: There is no fee if you have $50 or less left over on your TD Bank account.

Wells Fargo

This is another U.S. bank that offers an instant overdraft no direct deposit protection service. If you do not enable it and overdraw, you will be charged a $35 fee (limit of 3 fees per day, maximum of $105).

“Clear Access Banking” is the option offered by Wells Fargo. This is a bank account with no checks and no overdraft fees. Its features are:

- Open it for as little as $25.

- You only pay a $5 monthly maintenance fee (minors under $25 do not pay this).

- It is a checking account that does not require checks.

- Pay directly from your virtual wallet or contactless debit card.

Wells Fargo also has a grace period for those who overdraw. This is an extra business day to deposit the expense and avoid the overdraft fee. Therefore, it will reimburse you for the cost if you comply.

Best banks for overdraft

After mentioning what banks let you overdraft immediately, it’s important to know that several banks or credit unions have attractive overdraft benefits. One of the best that is worth highlighting is Capital One. It does not generate extra commissions, besides being one of the banks with the best facilities, for example, in terms of the ATM network.

Citibank is another of the best banks for overdrafts. They also do not charge fees and have a protection service. For example, if you pay with your debit card and there is not enough money, the purchase will be declined so that you do not generate overdrafts. In addition, coverage is available at no extra charge.

You can also open a free online checking account with no opening deposit. It may give you benefits on overdrafts as it is one of the banks that let you overdraft without direct deposit.

How much will a bank let you overdraft?

A bank may allow you to overdraft between $100 and $1,000. The amount will depend on the account holder’s income. This also varies according to the limit of money your bank allows you to withdraw.

For example, if you have $2,000, the overdraft limit may be $250. This means that you can spend $2,250.

Important: to know the overdraft limit is determined by the person’s transaction history, financial stability, debts, and account balance, among other aspects. Ask your bank about the amount you can overdraft, coverage, etc.

Can you overdraft if you have no money?

First, you should know that not having enough money and over-drafting are different things. On the other hand, although it is possible to overdraft, depending on the bank and the characteristics of the checking account, you will have to pay a fee for each overdraft, which can lead to you having to pay a considerable amount of money.

You must also understand the concept of overdraft. This implies that the bank pays for your purchase or gives you a certain amount if you make an ATM withdrawal. If this happens to you a lot, you can switch to a bank that offers facilities such as no overdraft fees.

We often need to know where they come from. For example, Chime is one of the online banks that let you overdraft right away. It is a banking application that does not generate hidden fees for overdrafts or services. It is an excellent alternative to prevent the money in your account from disappearing daily due to fees. Also, it is one of the banks with $500 overdraft protection.

You can also learn the Pros and Cons of Chime if you consider it to be a good option in overdraft matters.

Can you withdraw money from ATM with insufficient funds?

You can withdraw money from an ATM if you have insufficient funds, but only if you have overdraft protection. If so, you will then have to return the money and pay the transaction fee (if applicable).

Keep in mind that if you do not have this type of coverage and withdraw money from a debit card without having money in your instant overdraft bank account, the bank will automatically reject the transaction and the issuance of bank checks.

How to overdraft at ATM?

To utilize overdraft services at an ATM, you must first find out which banks let you overdraft immediately. Then, confirm that you have enrolled in one of the banks with overdraft coverage or have established overdraft protection on your account. Once this is in place, you can proceed to an ATM and withdraw an amount that surpasses your current account balance. Remember that this action may incur overdraft fees.

How Long do I Have to Wait to Overdraft My Account?

After knowing what bank let you overdraft right away, it’s important to be aware of how long does an overdraft take to activate, which can significantly differ based on the bank type and its particular policies. Traditional banks usually necessitate a waiting period ranging from 30 to 90 days prior to extending overdraft privileges to new bank account with instant overdraft holders.

This interval allows the banks with best overdraft to assess the account holder’s banking behavior and confirm responsible account management. Conversely, the advent of online banking has led to many digital banks that allow overdraft right away providing quicker access to overdraft privileges.

These banks with immediate overdraft protection often impose less rigorous requirements and are able to offer overdraft services more rapidly than their traditional counterparts. This approach forms part of their strategy to lure customers with the allure of speed and convenience.

However, despite these prevalent trends, note that the specific waiting period can greatly fluctuate from one bank to another. Elements such as the bank’s risk evaluation policies, the account type, and the account holder’s banking track record can all impact the waiting period.

Do you have to wait a few minutes or apply for overdrafts?

Generally, when you open an account at a bank that allows overdrafts, accepts the associated overdraft fees and features, and activates the service, you will be able to use it from the moment you have your account active.

Find banks that let you overdraft right away near me

If you are looking for banks that let you overdraft at atm right away, o banks that let you overdraft right away without direct deposit, there are some classic ways you can use to find free instant overdraft. So, if you wonder “what bank can I overdraft immediately”, we have just given you some of the best banks with immediate overdraft. Now, let’s see some tips on how to find banks that offer immediate overdraft nearest.

- Online Research: Start by conducting online research. Look for lists or articles that discuss banks with flexible overdraft policies. You can search for terms like “banks with immediate overdraft” or “online banks with no direct deposit required for overdraft“. Other terms you can use are “banks that allow immediate overdraft” or “what bank allows you to overdraft immediately”.

- Bank Websites: Visit the websites of various online banks. Look for their overdraft policies and fee structures to find what bank lets you overdraft the most. Some banks you can overdraft immediately may prominently display their overdraft options, while others may require you to dig into their terms and conditions or frequently asked questions (FAQs) to find the relevant information.

- Contact Customer Support: If you can’t find the information on their website, reach out to the customer support of the banks that allow immediate overdraft you are interested in. Ask specific questions about their overdraft policies, whether they offer bank accounts with instant overdraft, and if they require direct deposit for overdraft services.

- Read Reviews: Read reviews from other customers to learn about their experiences with the bank’s overdraft policies. Online reviews and forums can provide valuable information about bank account with overdraft, how the bank handles overdrafts, and whether they offer immediate overdraft options, or

- Check Online Banking Forums: Explore online banking forums and communities where users discuss various banks and their features. These forums can be a great resource for information from people with personal experiences with different banks with instant overdraft coverage.

- Compare Policies: Once you have gathered information from various sources, compare the overdraft policies, fees, and other features of the bank account with immediate overdraft you are considering. keeping all of these tips in mind and knowing what banks allow overdraft and what banks offer overdraft immediately, choose the one that best fits your needs and preferences.

References

- Gary Stein – (2017) Understanding the overdraft “opt-in” choice, Consumer Financial Protection Bureau. Available at: https://www.consumerfinance.gov/about-us/blog/understanding-overdraft-opt-choice/