Venmo’s person-to-person payment system has led the platform to become one of those methods that everyone should consider. Something that has encouraged the tens of thousands of users of the platform to try to make the most of it, even taking advantage of the activation of Venmo debit accounts.

Among them is the feature of being able to transfer money back to their bank accounts as needed and how to send money to yourself on Venmo. This is entirely possible with Venmo, and while it will take some time, it can be done seamlessly, regardless of whether you direct the money to your bank account or to one of your cards.

How can I transfer to my Venmo Account?

When we have a Venmo account the first thing we want to do is to increase the available transaction balance. To achieve this, rather than immediately linking a bank account, it is recommended to carry out the personal verification that allows you to have the Venmo balance available.

This balance acts as a wallet within the payment application, serving as an additional intermediary that is not your bank account directly. However, like any personal balance, the Venmo wallet will need you to deposit the money to be used. Adding money to Venmo is not complicated.

To do this, you must go to the “manage balance” section, where you can both confirm the account from which you want to transfer to Venmo and make the payment itself.

How can I send money to bank accounts with Venmo?

Sending money from Venmo to another personal account (Like PayPal) can be a real lifesaver for our economy in a time of trouble. Giving us the possibility to pay for a card, for example, or add the money to a debit card that we are going to use. Undoubtedly, it is one of those functions that every Venmo user should know the ins and outs of.

- Add the personal bank account to be transferred to

- Verify the bank account (not a mandatory step)

- Transfer the funds

This will result in a simple process in which you will have your money available in a matter of hours. This transfer can be done without any problems, either from your computer or Venmo’s mobile application. Carrying it out as if it were any other payment in a process that will take a few minutes before the money is in the air.

To consider

One point you should consider when carrying out this type of transaction is that as long as you do not use Venmo’s instant payment, the balance will take about 3 business days to be available. However, with instant payment, you will be able to avoid this wait in exchange for a small fee that varies according to the transaction.

Likewise, these fees will vary according to the total amounts to be transferred, so it is recommended to verify this information before making the transfer. Often, saving yourself the wait could be really worth it, or it could mean an additional cost that will be charged not from the transaction itself but from your Venmo balance.

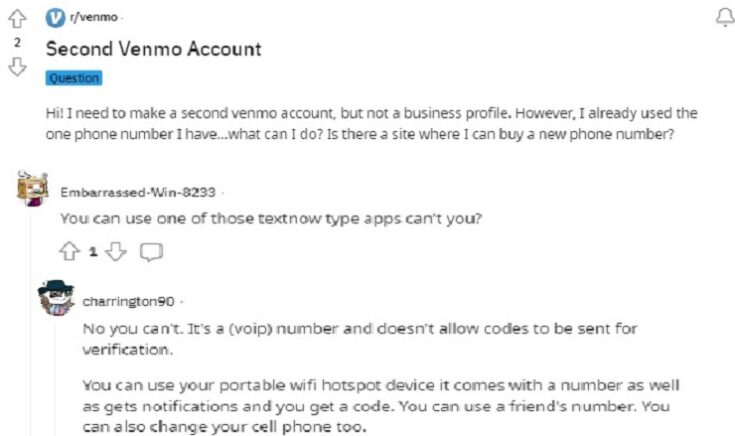

Can I have 2 Venmo Accounts and Venmo myself?

Another point that not everyone usually considers when talking about Venmo is that a user can have more than one account without problems. This feature is amazing for those who want to have an account to share with family or a partner. Or those who simply would like to divide their funds among several accounts.

Although this could in some cases generate real problems when moving money due to economic inconveniences, with Venmo this does not happen thanks to its facilitation system at the time of sending and receiving payments. Thus encouraging each transaction to be carried out without any problem.

So it is possible to Venmo yourself in case you have two accounts within the platform. Similarly, the fact that both Venmo accounts are in your name will not save you time waiting for the transaction. So you will still have to wait the 3 business days that this type of movement usually takes.

Can you Venmo yourself money from a credit card?

Many users wonder “Can you send money to yourself on Venmo?” or “Can I Venmo myself?” and the answer is yes. Although this might sound like an incredible alternative, unfortunately, you will encounter certain blocks to doing so. That’s why many people doubt about “Can I Venmo myself from a credit card?”.

When sending money from a credit card through Venmo, you’re setting rates of up to 3% for each of the transactions you carry out with money from a credit card.

So, can you pay yourself on Venmo? can I Venmo myself with a credit card? Yes, but the Venmo instant transfer fee is an inconvenience for those who plan to constantly withdraw money from their cards by using the application associated with PayPal. Similarly, this will only happen as long as the credit card belongs to the same owner of the Venmo account (that’s why can I pay myself on Venmo). However, this opens the possibility of making transfers from non-personal credit cards or using another Venmo account.

How can I send money to myself on Venmo?

Many people ask whether can I Venmo myself money and how can I send myself money on Venmo. While Venmo is primarily used for transferring money. between friends and family, it also has a feature that allows users to send money to themselves, so you need to understand how to pay yourself on Venmo. This can be useful for managing your finances, especially if you have multiple accounts or need to segregate funds for different purposes.

Venmo transfer money to yourself can be helpful for business owners who need to separate their finances or for individuals with multiple accounts to manage. That’s why understanding how to send money to myself on Venmo is so important. Let’s see a step-by-step guide on how to send money to yourself on Venmo:

- Start by opening the Venmo app on your mobile device. Alternatively, if you prefer to use a computer, you can navigate to the Venmo website. Both platforms offer the same functionality, so you can choose the one that’s most convenient for you.

- Once you’ve accessed Venmo, you must log in to your account. This involves entering your username and password. If you’ve forgotten these details, there are options to recover them.

- Before transferring funds, you must link your bank account or credit card to your Venmo account. This is a crucial step on how to Venmo yourself money, allowing Venmo to access the funds you want to transfer. To do this, navigate to the settings or account section of the app or website and follow the prompts to add a new bank account or credit card.

- After linking your account, you must go to the “balance” section. This can be found in the main menu of the Venmo app or website. Here, you’ll see an overview of your current Venmo balance and can add or withdraw funds.

- Select the account from which you want to transfer money. This could be the bank account or credit card you linked earlier. Make sure you have sufficient funds in this account to cover the transfer.

- Now, enter the amount of money you want to transfer. Be careful to enter the correct amount, as this process may not be easily reversible.

- After entering the amount, you must confirm the transfer. This may involve following additional prompts or security measures, such as providing a verification code or password. These measures are in place to protect your account and ensure the transfer is authorized.

- Once you’ve confirmed the transfer, Venmo will process your request. This may take a few moments. When the transfer is complete, the funds will be added to your Venmo account balance and will be available for you to us. That’s how do I Venmo myself.

After learning how to send yourself money on Venmo, don’t forget that Venmo does not allow you to send money directly to your own Venmo account. However, you’re effectively sending money to yourself by transferring money from your bank accoun t or credit card into your Venmo account.

References

-

“Adding Money to Your Venmo Balance.” Help Venmo, https://help.venmo.com/hc/en-us/articles/360012932154-Adding-Money-to-Your-Venmo-Balance.

-

“Bank Transfer Timeline.” Help Venmo, https://help.venmo.com/hc/en-us/articles/221083888.

-

“How to Transfer Money to a Bank Account.” Help Venmo, https://help.venmo.com/hc/en-us/articles/221011188-How-to-Transfer-Money-to-a-Bank-Account.

-

Staff, Editorial. “How to Venmo Myself Money From a Credit Card? Fee &Policies.” VenmoGuide.Com – Beginner’s Guide to Venmo, https://venmoguide.com/can-i-venmo-myself-money-from-a-credit-card/.

-

Staff, Editorial. “How to Venmo Yourself on Venmo: Step-by-Step (2024 Tutorial).” VenmoGuide.Com – Beginner’s Guide to Venmo, https://venmoguide.com/can-you-transfer-money-to-yourself-in-venmo/.