Lumber liquidators are one of the most popular retailers in the United States for purchasing hardwood flooring. These items are expensive, so it is common to find special financing to buy them.

The credit card offered by this retailer is ideal for those who want to get their hardwood flooring. It is a way to obtain financing and secure savings for your new floors. Those who buy it know how to make the most of it.

Lumber liquidator’s credit card payments

Timely payment of the Lumber Liquidator’s credit card is essential to access all the benefits they offer to users. Invoices are sent out every month on the same date, and it is essential to stay on top.

Online Payments

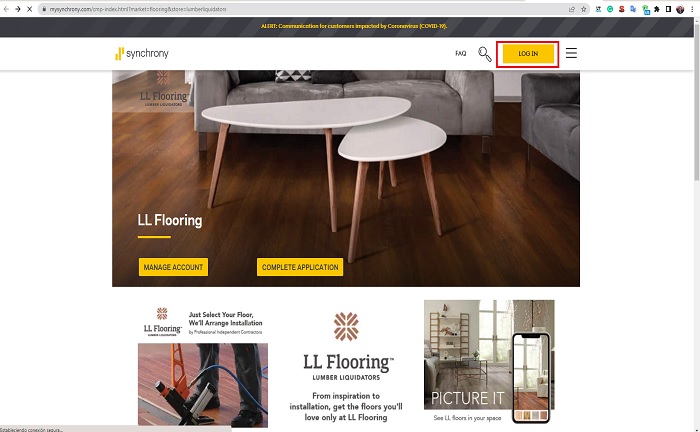

Synchrony Financial issues the Lumber Liquidator’s credit card. Therefore, it is necessary to create an account with Synchrony Financial. Once on the home page, go to “log in”.

Register from scratch by selecting the “register” option for new clients. A new page will appear with a form you need to fill in with all the personal and credit card information requested by the platform.

Once completed, it is time to create a username and password according to the site’s rules, and it will be completed when you receive an email verifying the new account. The whole process takes less than 10 minutes in total.

Once the account is online, it is time to log in by returning to the home page. Enter the username and password created and log in. On the new page, locate the option “make a payment”.

Here you will add the amount to be paid and the bank details from where you will transfer money, which can be a checking account. It is advisable to activate automatic payments to avoid having to go through with this procedure every month.

It is only necessary to choose an exact date and a minimum amount that will be deducted every month from that moment on. Likewise, when the payment is made, the bank will notify you of the transaction and tell you that the funds have been deducted.

After entering all the information and activating the corresponding options, it is time to click on “pay“. It will be processed immediately, so it is the ideal choice. Through this account, you can monitor constantly the executed transactions, statements and all the information related to the credit card.

Payments by mail or telephone

Alternatively, you can pay your credit card by mailing your check or money order to Synchrony Financial, PO BOX 960061, Orlando, FL 32896 – 0061. Remember to include the account number on the bill.

With this alternative, we should make payments 5 to 10 business days before the invoice is due to avoid additional charges for late fees and to be able to resolve any inconvenience with peace of mind.

The other alternative is to contact Lumber Liquidators customer service at 1 – 866 – 396 – 8254, the dedicated credit card payment number, and you can complete the entire process through the operator.

If there are any inconveniences, there is the possibility of asking to speak to one of the agents. However, this option has additional fees, usually around $15 per call. The operator is responsible for verifying this before connecting the call with one of the agents.

Is the Lumber Liquidators credit card a good option?

As we mentioned before, it is one of the popular retailers in selling hardwood flooring. They have a long history in the country because of the competitive prices offered. Currently, there is the option of acquiring a credit card.

To begin with, they offer two financing offers; the first is a six-month interest-free period on purchases under $999. The other is a 12-month interest-free period for all purchases over $1,000.

To access the plan, make the minimum monthly payment to complete the total amount in the period corresponding to your financing.

Otherwise, interest will be applied to the total balance and counted from when you made the purchase.

It has an APR of 29.99%, and it is impossible to make balance transfers or cash advances with the card. The minimum interest charge you will see is $2, and late or returned payment fees are at a maximum of $35.