Best Buy’s warehouse-style stores and commission-free staff are the brand’s most popular features.

To have a better affinity with their customers, they have two credit cards available to make purchases at any of the 1,200 stores nationwide.

Buying electronics is rarely a small expense.

Laptops, TVs, appliances, phones, and home tech often land in the hundreds or thousands of dollars. That is exactly why Best Buy offers its own credit cards.

The promise is simple: easier payments, store rewards, and occasional interest-free financing.

But the details matter. A lot

The Two Best Buy Credit Cards and Why the Difference Matters

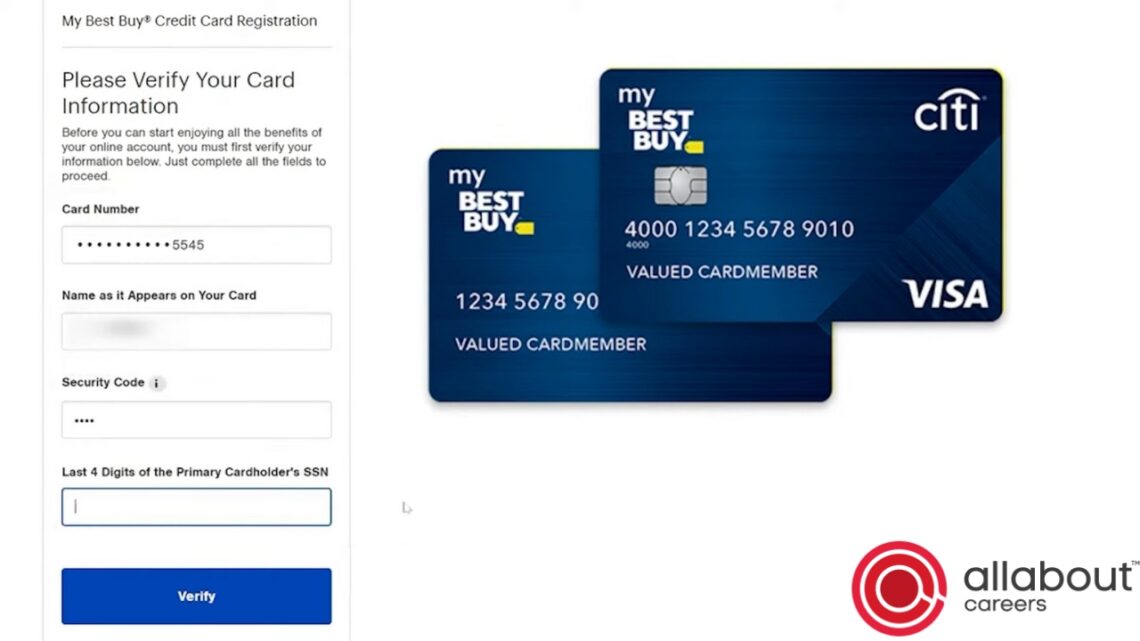

Best Buy does not issue a single credit card. It offers two distinct products, both issued by Citibank, and the difference between them affects almost everything else about how the card functions.

The first option is the My Best Buy Credit Card, often called the store card. This is a closed-loop card, meaning it can only be used at Best Buy stores and on BestBuy.com.

It has no annual fee and is generally easier to qualify for than the Visa version. Because it cannot be used elsewhere, it is designed purely for customers who already shop at Best Buy.

The second option is the My Best Buy Visa Credit Card. This is an open-loop card that runs on the Visa network and can be used anywhere Visa is accepted.

Depending on your credit profile, it may come with no annual fee or a $59 annual fee. When you apply, Citi typically evaluates you for the no-fee Visa first, then the fee-based Visa, and finally the store card if you do not qualify for the others.

The structural difference between these cards explains why some people swear by them while others regret signing up.

Where and How You Can Pay Online

Best Buy credit card payments are handled through Citi’s account management system rather than through a separate Best Buy checkout portal. Once your card is activated, you can log into your Citi account to view balances, statements, and due dates.

Online payments are free and can be made directly from a linked checking account. Most users set up automatic payments to avoid late fees, which can reach $40 per missed payment. Payments typically post within one to two business days, depending on when they are scheduled.

The system also allows you to choose electronic statements instead of paper mail, which is useful for tracking promotional financing deadlines. Missing a financing deadline by even a day can be costly, so visibility matters.

Understanding the Rewards Without Marketing Language

One of the biggest selling points of Best Buy credit cards is rewards, but the structure is often misunderstood. These cards do not provide direct cash back.

Instead, they earn points that convert into Best Buy reward certificates.

Each point is worth two cents. Once you accumulate 250 points, you receive a five-dollar reward certificate that can be used at Best Buy. These certificates cannot be redeemed for cash and generally have expiration dates.

The earning rate depends on where and how you use the card.

Purchase Category

Points Earned

Real Value

Best Buy purchases

2.5 points per dollar

5 percent back

Gas (Visa only)

1.5 points per dollar

3 percent back

Dining and groceries (Visa only)

1 point per dollar

2 percent back

All other purchases (Visa only)

0.5 point per dollar

1 percent back

When you spend one thousand dollars at Best Buy, you earn 2,500 points, which translates to fifty dollars in Best Buy certificates. That is a strong return for store-specific spending, especially on big electronics purchases.

However, the value only exists if you plan to shop at Best Buy again. Unlike general cash-back cards, there is no flexibility to use rewards elsewhere.

Signup Bonuses and First-Day Incentives

View this post on Instagram

New cardholders are often offered a promotional bonus that advertises ten percent back on the first day of purchases. In practice, this is usually a combination of the standard five percent reward rate plus an additional five percent promotional bonus.

The purchase must typically be made within a short window after approval, often within fourteen days. For someone already planning a large purchase, this can be a meaningful incentive.

A two-thousand-dollar purchase during the bonus window can generate two hundred dollars in reward certificates.

For impulse applicants with no planned purchase, the bonus loses much of its appeal.

Interest Rates and the Cost of Carrying a Balance

Where Best Buy credit cards become risky is the interest. The standard purchase APR is high, commonly hovering around thirty percent variable.

Cash advances and balance transfers carry similar rates, along with fees.

Cost Element

Typical Terms

Purchase APR

Around 30 percent variable

Cash advance APR

Around 29 percent

Balance transfer fee

5 percent minimum fifteen dollars

Late payment fee

Up to forty dollars

These rates mean that carrying a balance for even a few months can erase the value of any rewards earned.

Deferred Interest Financing Explained Properly

@okaygnomie I wish i could be on your level i truly do #fyp #foryoupage #foryou #bestbuy #retail #financing ♬ Originalton

Best Buy frequently promotes deferred interest financing, especially on large purchases such as televisions, appliances, and laptops. Offers range from six to twenty-four months.

This type of financing is often mistaken for a true zero-percent APR offer. It is not.

Deferred interest means that interest is calculated from the day of purchase but temporarily hidden. If the full balance is paid before the promotional period ends, the interest is waived.

If even a small balance remains after the deadline, all the accumulated interest is added back to the account.

Scenario

Outcome

Balance paid in full before deadline

No interest charged

One dollar remaining after deadline

Interest added to entire original balance

This structure rewards perfect payment behavior and penalizes small mistakes heavily. It works best for people who track their statements carefully and pay more than the minimum every month.

Credit Approval Reality

Best Buy does not publish minimum credit score requirements, but approval patterns are consistent. The store card is the easiest to obtain and is often approved for applicants with fair credit.

The Visa versions typically require good to very good credit, with the no-fee Visa reserved for stronger profiles.

Because the store card is easier to get, many first-time applicants end up with a product that cannot be used outside Best Buy, which limits its long-term usefulness.

How These Cards Fit Into Real Consumer Behavior

Most American adults already have multiple credit cards. Store-specific cards like Best Buy’s are rarely primary financial tools.

Instead, they are secondary cards used for specific purchases where the rewards or financing justify their use.

For someone who shops at Best Buy once every few years, the card adds complexity without much benefit. For someone who regularly buys electronics, appliances, or home tech from Best Buy, the rewards can be meaningful if balances are paid responsibly.

The Real Pros and Cons in Plain Language

The main strength of Best Buy credit cards is their reward rate on Best Buy purchases. Five percent back in certificates is competitive within the world of store cards.

The signup bonus and financing offers can also reduce upfront costs for planned purchases.

The weaknesses are just as clear. Rewards are locked to one retailer, interest rates are high, and deferred interest financing leaves no margin for error. These cards reward discipline and punish casual use.

Final Perspective

A Best Buy credit card is not a general-purpose financial product.

It is a specialized tool designed for people who already spend money at Best Buy and are comfortable managing due dates and balances precisely.

Used carefully, it can reduce the cost of expensive electronics and appliances. Used casually, it can quietly become an expensive mistake.

María Laura Landino is a journalist who graduated from Boston University with more than four years of experience in the financial sector. He has been responsible for several research papers published by major universities.

Content Manager of allaboutgroup company. You will find me in job and Finance sections.